Why do I need Long-Term Care Insurance?

Previous generations did very little planning for long-term care needs because family members were usually available to provide care. But changes in society, demography, and the family make this arrangement less feasible today and in the future. Smaller families, high migration patterns, more women in the workplace, and increased longevity mean a family member is less likely to be available as a caregiver, while you are more likely to need long-term care in the future.

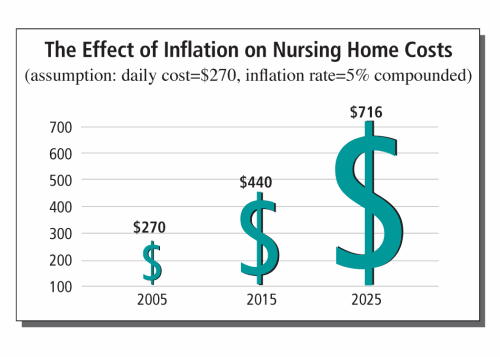

Rising nursing home costs

Today, the cost of nursing home care in the United States varies from $50,000 to over $100,000 per year. In New York, the average nursing home cost is over $90,000 annually. This nursing home cost will more than double in 15 years if the current growth rate in nursing home costs continues.

Medicare, Medicare supplemental insurance (Medigap), and traditional health and disability insurance plans do not typically cover long-term care. Persons who may be able to afford long-term care through their income and personal savings represent a small minority of U.S. citizens. For most people, the options for financing long-term care are long-term care insurance or Medicaid, after spending down personal assets.

A Means of Protection

Quality long-term care insurance is a means of protecting your financial independence against the event of costly long-term care in the future. New York State and the federal government also consider long-term care insurance a viable financing option and, therefore offer long-term care insurance to their employees, retirees, and their family members. Many financial experts today recommend long-term care insurance as a key element for most personal financial and retirement plans.

Last updated: March 2006. Privacy Policy